15 July 2020

Fool’s Gold

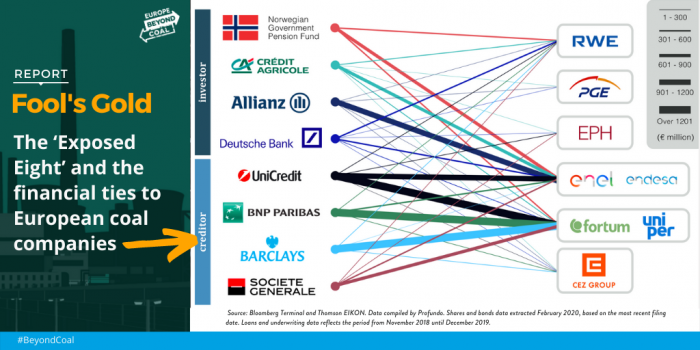

Download ReportUpdated for 2020, Fool’s Gold – The financial institutions risking our renewable energy future with coal examines eight European, and four significant international, financial institutions with close ties to Europe’s eight most polluting coal companies, finding that all continued to pump money into companies responsible for half of all EU coal-based CO2 emissions in the year after the IPCC released its 1.5 degrees C special report in Oct 2018.

These European financial institutions, international investors, and banks including BlackRock and the Japanese megabanks, are keeping Europe’s terminally declining coal industry on life support, handing companies €12 billion in investment, and €9.8 billion in loans and underwriting in less than 1.5 years. Such financial support is risking Europe’s ability to hit UN Paris Climate Agreement targets, and hindering renewable energy development.

Europe’s most coal-exposed investor was the Norwegian Government Pension Fund, which invested €1.5 billion in shares and bonds, closely followed by Crédit Agricole with €1.4 billion, Allianz with €1.1 billion, and Deutsche Bank with €1.0 billion. Internationally, BlackRock’s investments totalled €7.0 billion.

On the creditor side, UniCredit provided €2.8 billion in loans and underwriting services, followed by BNP Paribas with €2.1 billion, Barclays with €1.7 billion and Société Générale with €1.3 billion.

Japanese megabanks Mizuho Financial Group, Sumitomo Mitsui Financial Group (SMBC) and Mitsubishi UFJ Financial Group (MUFG) have provided loans and underwriting of €1.9 billion.

European financial institutions have been releasing nearly one new policy per week limiting financial ties to coal companies so far in 2020. While some financial institutions have recently adopted stricter coal exclusion policies, some remain too weak, and others need to be proven. Fool’s Gold shows that a huge amount of support for coal is still getting through overall.